Menu

Close

HMRC recently released CEST 2.0, an uneventful update of their digital IR35 assessment tool. The release involved re-platforming the tool to sit on new technology which, whilst beneficial, meant very little to the user.

That said, HMRC is continuing to make much-needed improvements to the Check Employment Status for Tax (CEST) tool designed for engagers to check the employment status of their off-payroll workers.

The next release is expected to see updates to the questions themselves. One area I desperately hope will see an improvement is that of personal service, otherwise known as the right of substitution.

The right of substitution is one of the key factors when it comes to determining IR35 status (whether you are employed or self-employed for tax purposes). It’s based on the concept that a genuine business would be able to provide any suitable personnel to fulfill the services, whilst an employee would not be able to send another person to do their work.

Therefore, if a contractor can provide a substitute worker, it’s a clear demarcation and indicator that they’re self-employed and not a disguised employee of their client.

The right of substitution is often viewed as a bit of a “golden bullet” in IR35 status. If you've provided a substitute worker to fulfill the services on behalf of your company, the chances of HMRC proving that you’re a disguised employee are virtually nil.

However, whilst at a high level the concept of substitution is pretty simple, as with most things IR35, nuances and technicalities mean that it can be difficult to confidently establish an opinion on a particular situation.

For example, you can have a right of substitution in the written terms of your contract, but if that right is too limited or “fettered”, it will be rendered worthless.

In building the CEST tool, HMRC naturally had to cover the substitution test which will always have posed a challenge given the tool provides an algorithmic result and can’t delve into the specifics of a particular engagement.

So, have they done it well?

Given its prominence, the right of substitution is the first section of the assessment. It starts logically enough asking if a substitute has been sent. If the answer is yes, then the tool goes on to clarify if the worker was paid by the contractor’s company, which is a prerequisite for genuine substitution. If the answer is yes again, then the result will be outside IR35 (self-employed for tax purposes).

But if substitution hasn’t occurred in practice, we then have to rely on the hypothetical existence of a right to substitute, and this is where the problems lie. It’s also the most likely scenario for contractors who will seldom need to exercise their right of substitution.

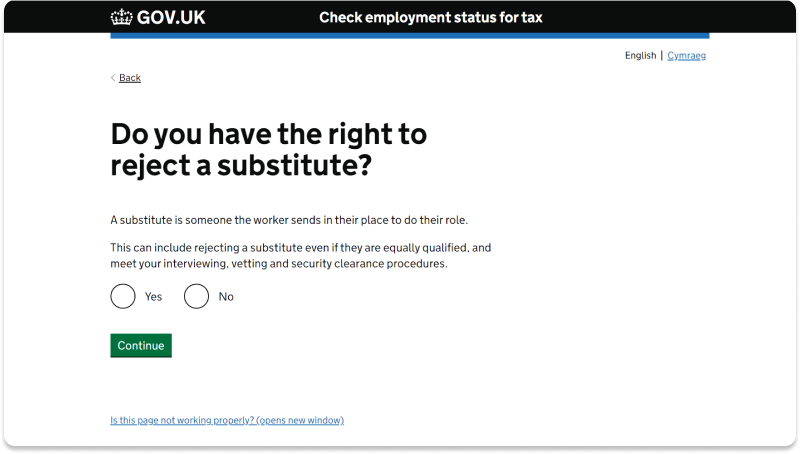

Rather than asking if a right of substitution exists, CEST asks if the client can reject a potential substitute. A small amount of explanatory text states that “this can include rejecting a substitute even if they are equally qualified, and meet your interviewing, vetting and security clearance procedures.”

The user then has a binary yes or no choice. If they state that they can reject a replacement, this effectively nullifies the substitution test meaning the decision for IR35 status will be based on other factors.

Unfortunately, this very basic question doesn't paint the full picture leading engagers to potentially incorrect results via the CEST tool.

There is guidance designed to accompany the tool contained within HMRC’s Employment Status Manual.

The Employment Status Manual (ESM) is a guide for both HMRC’s own tax inspectors and the public to understand and apply the rules around all aspects of employment status, including IR35. It’s been around for decades and is regularly updated when legislation and case law changes.

There is a section in the ESM devoted to CEST (ESM11000). The CEST tool however fails to link to the manual, making it difficult to find especially for users who may not have any awareness that it even exists; a clear oversight in the provision of a tool set out to help assess status.

The question about rejecting a substitute also has its own page in the manual which adds vital clarification and would undoubtedly change the answer for many hirers:

“Where the hirer can only reject a substitute upon grounds that they are not qualified to perform the work, this would fall within the ‘No’ category for CEST provided it would be practical and plausible for the worker to send a substitute.”

A significant proportion of end hirers are probably unwittingly answering incorrectly on the basis that they would reasonably reject a substitute if the substitute wasn’t suitably qualified, and getting inside-IR35 results when they should be outside IR35. Given the natural inclination for end clients to use CEST to assess IR35 status, this is deeply problematic.

It has been a frustrating issue for a long time, and we hope that HMRC will share our view for the need to link the Employment Status Manual within the CEST tool itself, as well as improve the explanatory notes alongside this question.

We can only wait and see what changes are brought about in the next CEST update, and if you're using CEST to determine IR35 status, please review the Employment Status Manual to ensure an accurate reflection of the engagement.

Read more about CEST and why we don’t recommend relying on this tool to assess IR35 status.

Ask away! One of our team will get back to you!