Menu

Close

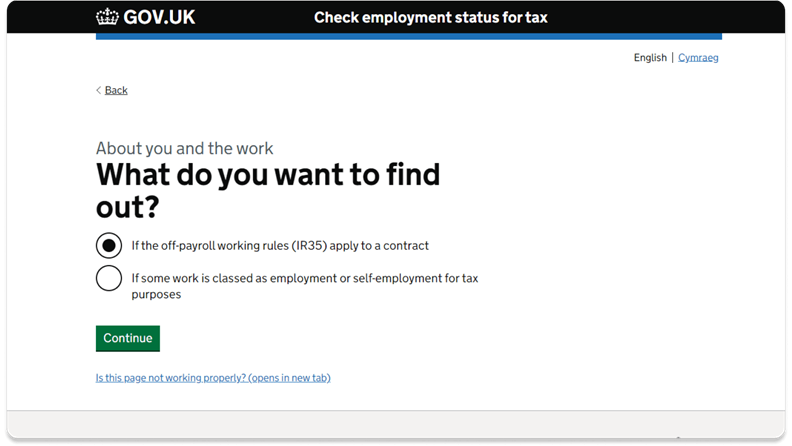

HMRC has confirmed the roll-out of changes to its Checking Employment Status for Tax (CEST) tool, which took effect on 2nd October.

The move, reported by Computer Weekly last week (4th October), is a rare update to CEST. The tool is widely considered to be flawed, but little has been done by HMRC to improve it since its arrival.

However, this heavily criticised tool will now have been used millions of times since it was introduced in 2017 and many businesses continue to rely on the technology to determine IR35 status.

But have these eagerly anticipated changes to CEST done the trick? And is the tool fit for purpose?

Let’s take a look…

Before focusing on the changes themselves, it’s worth remembering what the old version of CEST offered. This gives us a benchmark to measure against – a bit of a low one.

CEST was released just before the roll-out of the off-payroll working rules in the public sector in 2017. Between November 2019 and August 2021 – the most recent usage figures available from HMRC – CEST was used almost 2million times by contractors, end-clients and recruitment agencies.

Despite the wide user base, the tool has consistently attracted criticism, with a number of failures contributing to its poor reputation.

One fault is its inability to factor crucial aspects of case law into its decisions, particularly Mutuality of Obligation (MoO), which doesn’t exist in all engagements – as evidenced by several recent tax tribunal cases. But HMRC and, in turn, CEST, seem to believe that it does.

Added to its questionable logic, the tool is unable to provide an answer – by this, we mean to determine whether a contract belongs inside or outside IR35 – 21% of the time.

You can learn more about CEST’s flaws here.

Onto the updates themselves…

The main change has been to re-platform CEST onto HMRC-designed software, ‘Ocelot’.

Ocelot “enables the rapid production of interactive guidance”. According to Computer Weekly, “the migration to Ocelot is the first of a two-phased revamp”. The second phase will see “updates made to the questions that CEST uses” in its determinations.

From a user’s point of view, this may make CEST easier to navigate in due course – although there’s no sign of this just yet. It also, in theory, will allow changes to be made to CEST on the fly. But what these changes will be is anybody’s guess.

So while the re-platforming of CEST may well be useful, the latest version of the tool operates very similarly. That said, giving users access to technical guidance via HMRC’s Employment Status Manual could be seen as a positive development, assuming the user has a grasp of this.

These changes may turn CEST into “a learning device”, according to a former HMRC revenue official quoted on Contractor UK. This could make it easier for contractors and CEST users to understand “which areas of contracts are problematic”.

In short, this update is about the system's functionality; a facelift rather than a comprehensive redesign.

So, while this update – or the Ocelot software generally – may lead to future improvements, the reality is that CEST has simply been moved onto a new platform.

There’s no immediate change to the logic that underpins CEST. When this will happen – if ever – remains to be seen.

This means that the tool is not fit for purpose. As such, our advice remains that contractors, businesses and recruiters should not rely on CEST in isolation for IR35 status assessments.

Ask away! One of our team will get back to you!